Watermill Portfolio

OUR PORTFOLIO COMPANIES SHARE UNTAPPED POTENTIAL; WE GIVE THEM THE TOOLS TO ATTAIN IT

Working in collaboration with management teams, we add the strategy, structure and systems that unleash flexibility, creativity and entrepreneurialism. We help our family of Watermill companies re-imagine the future and realize new possibilities. Click through the case studies below to learn more about the companies we believe in.

CURRENT PORTFOLIO COMPANIES

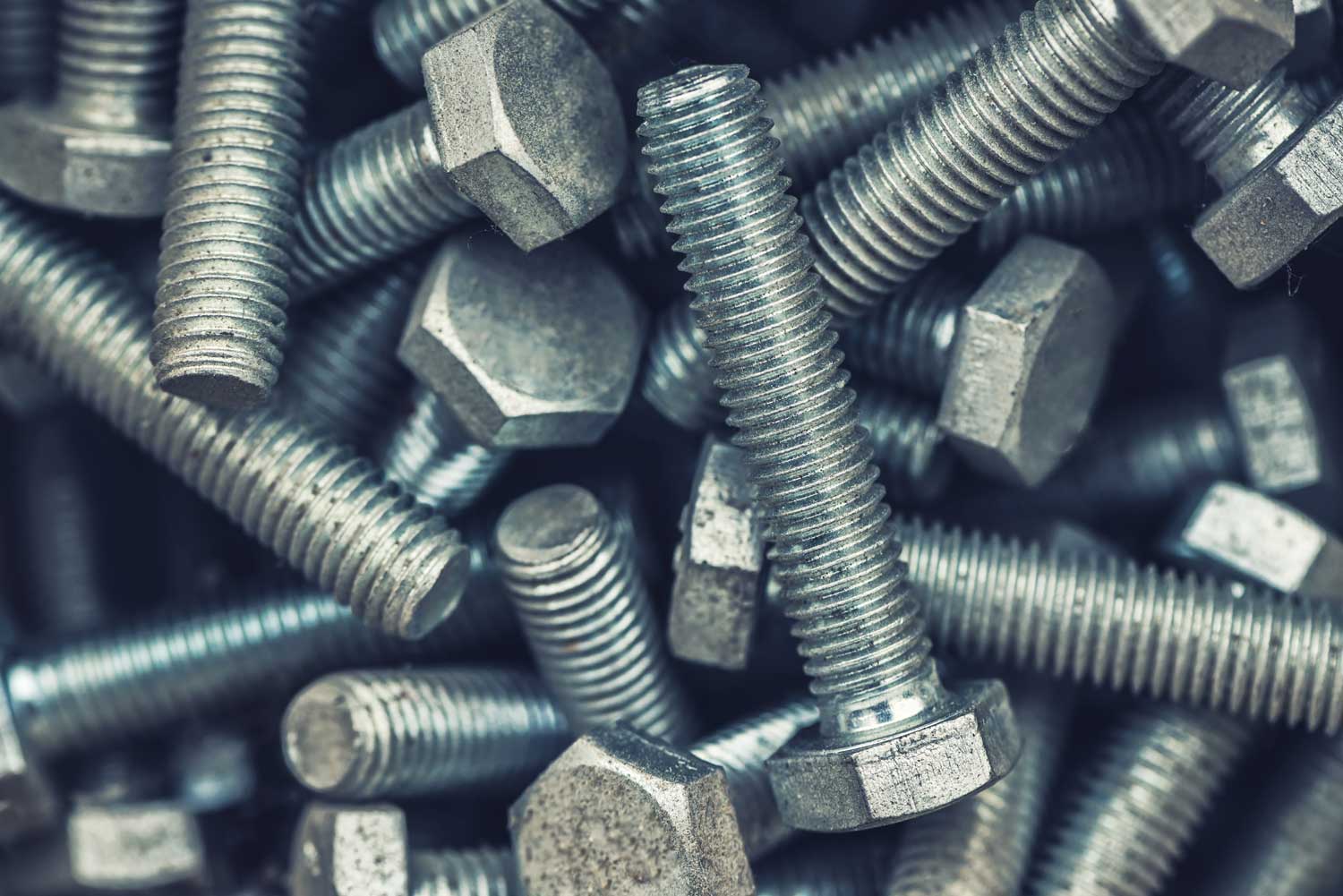

Beck Industries

Industrial Fasteners

Cooper & Turner

Industrial Fasteners

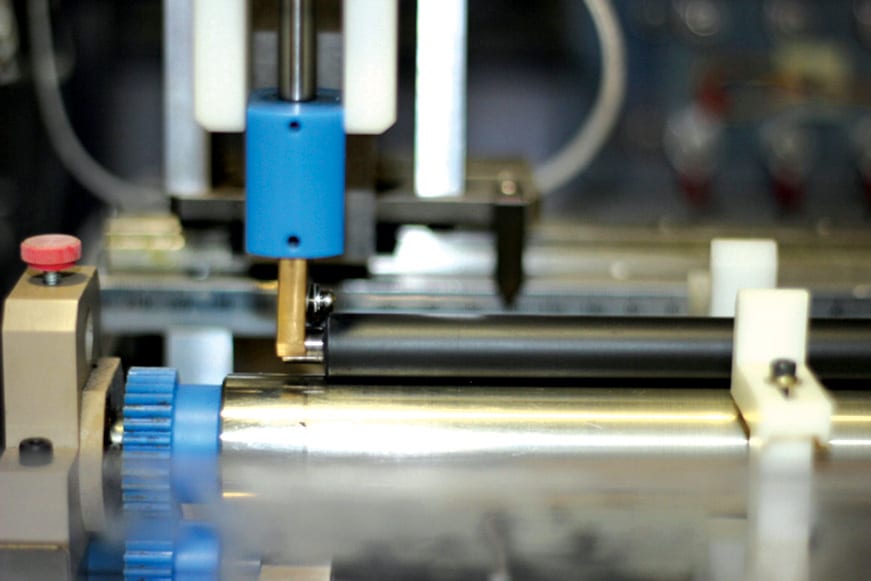

QMC-EMI

Metal Solutions

Beck Industries

Beck Industries

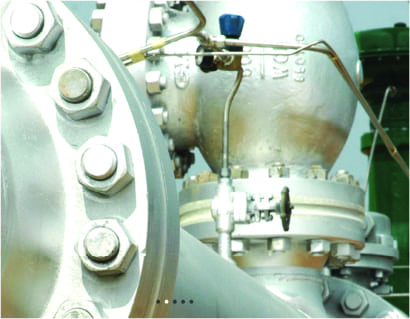

Beck Industries International Sprl is a European manufacturer and distributor of fully certified, high-security bolting components for refineries, power generation, subsea oil & gas and the nuclear power end markets. Founded in 1918 by Hélène Beck Crespel, the company is now a fourth-generation family business that has grown into an international entity with nine locations in Europe, Asia and North Africa.

Acquired July 2019

Family Transition and Strategic Growth

Industrial Fasteners

CASE STUDY

Where others see:

Two family-owned, entrepreneurial businesses – one with a strong yet concentrated presence in the growing wind energy market (Cooper & Turner) and the other with a firm foothold, outside the US, in power generation and subsea oil & gas (Beck Industries).

We envision:

The combined company aims to be the first truly global manufacturer of safety-critical fastening applications, supporting a broader range of industries – including renewable energy, downstream oil & gas, power generation, nuclear, rail, tunneling, construction and heavy equipment, among others

Watermill will:

- Complement family management to build systems and processes to execute our shared vision.

- Support the launch of manufacturing and distribution operations in the United States, while expanding services across a broader range of industries.

- Support the combined management team in accelerating growth and innovation across global energy and infrastructure markets.

Close

Cooper & Turner

Cooper & Turner

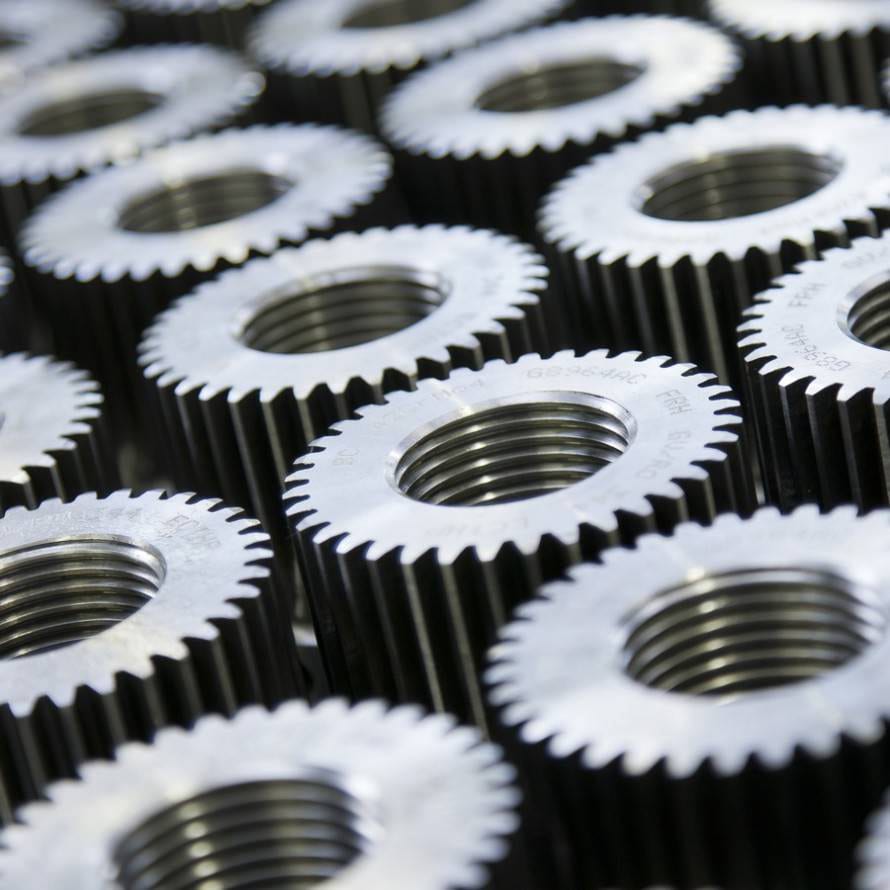

Cooper & Turner is a leading manufacturer and distributor of high-strength industrial fasteners including large diameter anchors, studs, bolts, and nuts. These fasteners are often mission-critical and are required to meet the highest quality standards in order to perform in safety-critical and extreme applications.

Headquartered in Sheffield, England, C&T serves a global customer base with strategically positioned manufacturing and distribution operations across the EU, China and the U.S. This global network enables the Company to offer a seamless, global, one-stop shop solution to blue chip customers in wind energy, construction, OEM, rail, and tunneling end markets.

Acquired August 2017

Family Transition and Strategic Growth

Industrial Fasteners

CASE STUDY

Where others see:

Two family-owned, entrepreneurial businesses – one with a strong yet concentrated presence in the growing wind energy market (Cooper & Turner) and the other with a firm foothold, outside the US, in power generation and subsea oil & gas (Beck Industries).

We envision:

The world’s first, truly global manufacturer and distributor of safety-critical fastening applications, supporting a broader range of industries with a seamless, one-stop shop solution for industrial fasteners that meet the highest levels of quality.

Watermill will:

- Complement family management to build systems and processes to execute our shared vision.

- Support the launch of manufacturing and distribution operations in the United States, while expanding services across a broader range of industries.

- Support the combined management team in accelerating growth and innovation across global energy and infrastructure markets.

Close

Quality Metalcraft, Inc. and Experi-Metal Inc.

Quality Metalcraft, Inc. and Experi-Metal Inc.

In just over 12 months, Watermill acquired two Detroit based, complementary automotive metal forming companies:

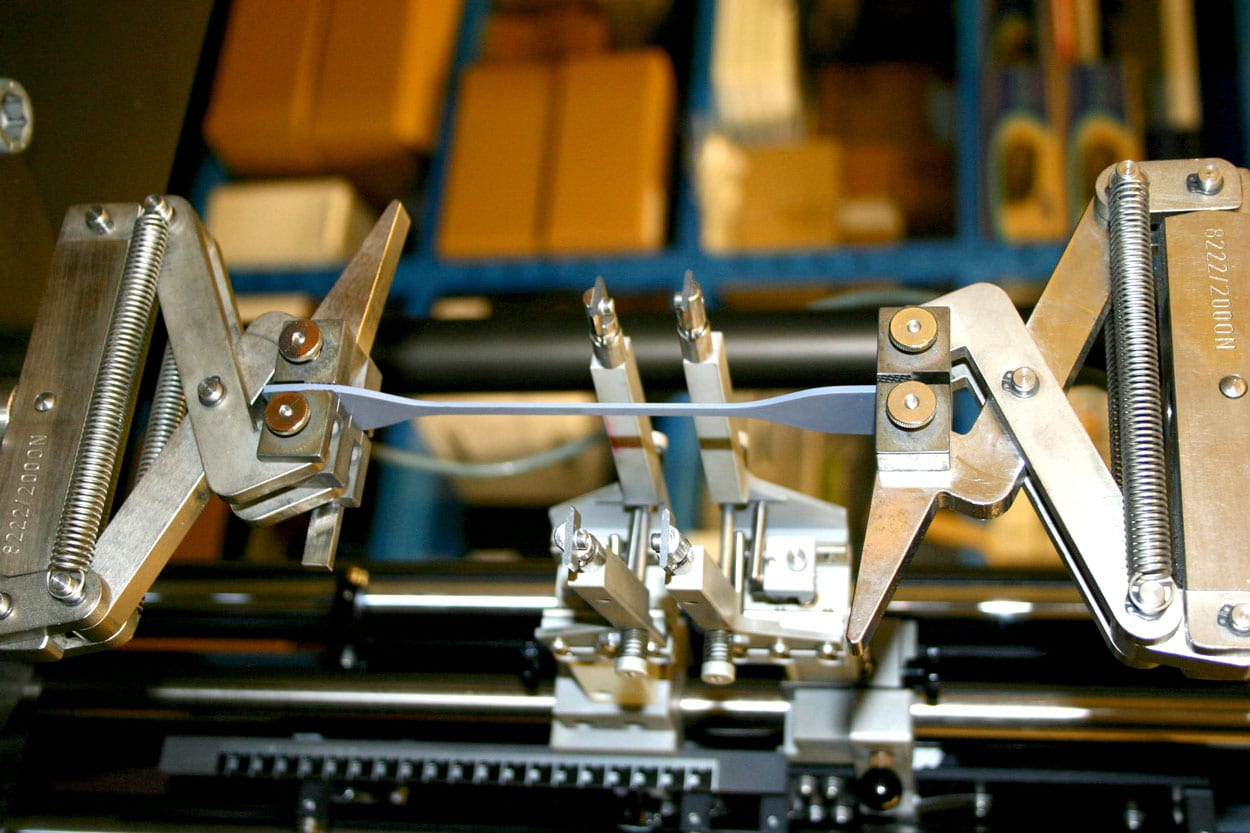

Quality Metalcraft, Inc (QMC) is a leading producer of engineered structural metal components and assemblies, providing advanced prototype, low-to-medium volume production and factory assist services to automotive and other specialty vehicle industries. As a go-to source for the world’s major manufacturers when quick, quality solutions are needed, QMC offers a range of capabilities, technologies and services to provide the optimal production process for any project.

Experi-Metal, Inc. (EMI) is a leading provider of highly engineered, metal formed prototypes, sub-assemblies, full Body-In-White (BIW) assemblies and certain forms of low-volume production in the automotive, aerospace, defense and alternative energy industries. Since 1959, customers have relied on EMI’s attention to excellence and dedication to continuous improvement. As advances in technology progress, EMI’s standards for quality, performance and safety enable its customers to remain on the leading edge.

Acquired June 2015 and July 2016

2 Family Exits

Metals Solutions

CASE STUDY

Where others see:

A metals stamping company and an automotive prototype company both located in Detroit and both serving a cyclical industry which has been mostly unchanged for decades.

We envision:

Two collaborative companies which together will offer complementary, end-to-end prototype and niche production services to OEMs, automakers and new entrants to the mobility market and other industries.

An unparalleled partner to discerning customers that responds quickly, creatively and with exceptional service levels; without compromising quality or precision and which helps customers stay on top of rapidly developing new technologies and intensifying market demand.

A nimble design and manufacturing resource capable of supporting customers to quickly design and launch new models, easily target niche consumer segments and create better, safer vehicles.

The go-to resource for providing critical bridge production support and factory assist services to launch or keep customers’ production lines running in times of fluctuating manufacturing capacity

Watermill will:

- Help the companies develop a long term collaborative strategy that will deepen the their shared and unparalleled commitment to service

- Utilize both companies broad capability range to create a comprehensive, end-to-end service offering to better enable customers who seek creativity, speed, flexibility and quality

- Strategically bolster capabilities to further enable customers to access niche markets, discerning consumers, and emerging technologies and markets

- Drive operational improvements throughout both companies

Close

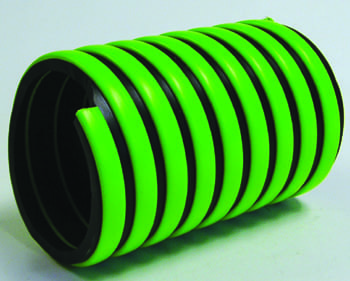

Enbi

Precision Rollers & Components

Weston Forest

Lumber Distribution & Remanufacturing

Musser Biomass and Wood

Premium Dried Wood Fiber

Enbi Group

Enbi Group

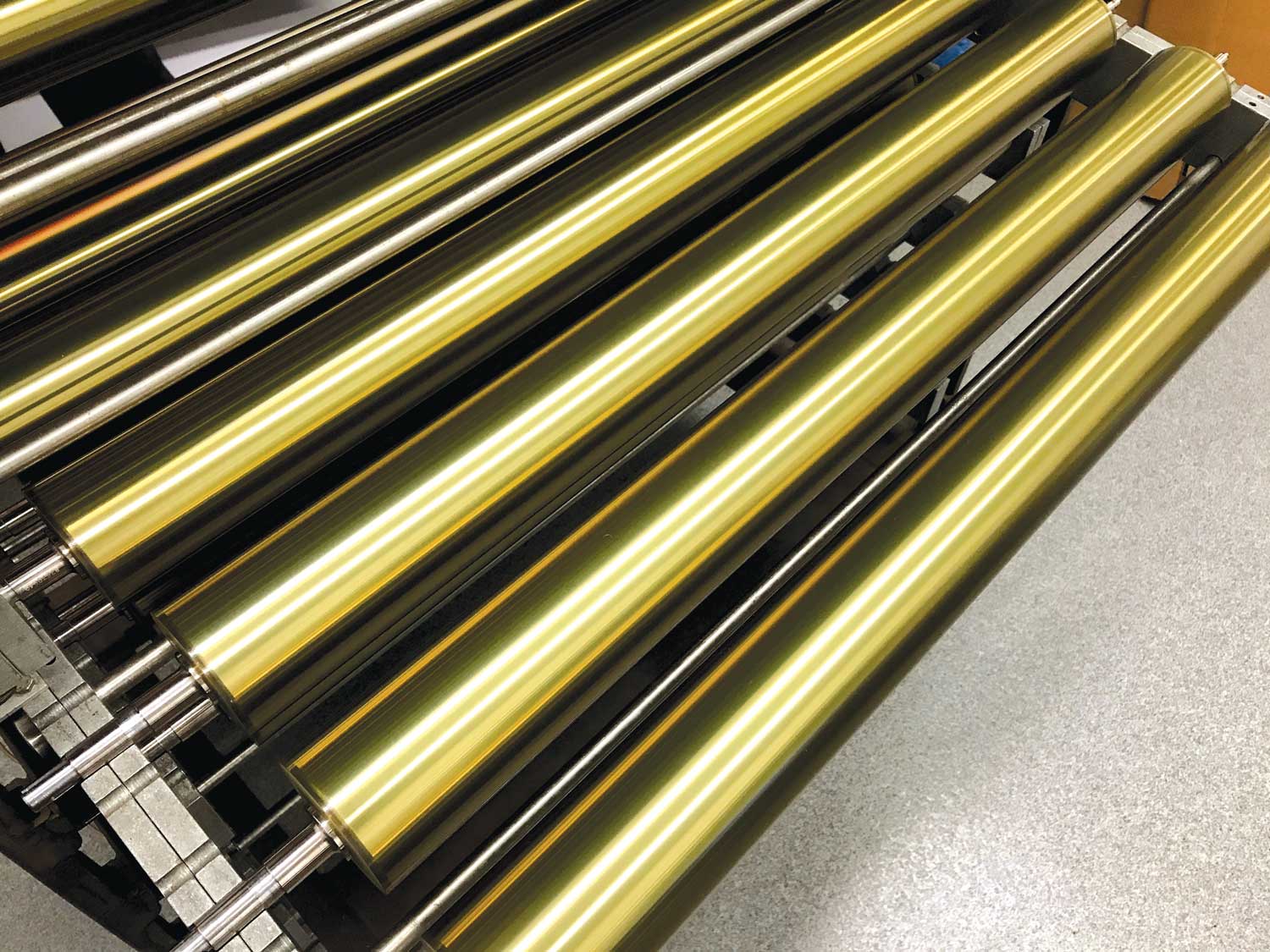

A leading manufacturer of high-performance precision rollers, insulation and sealing technologies. Best-in-class OEMs in the digital printing, ATM, HVAC and automotive industries turn to Enbi when exacting precision and quality are critical to end-product performance. The company serves a worldwide customer base from its headquarters in Shelbyville, Indiana as well as manufacturing facilities in the US, Europe and Asia.

Acquired March 2019

Strategic Growth

Precision Rollers & Components

CASE STUDY

Where others see:

A small manufacturer of precision rollers, gaskets, seals and insulation with global complexity and limited strategic direction.

We envision:

A leading global manufacturing and engineering partner, innovating mission critical products and delivering quality service to rapidly evolving markets.

Watermill will:

- Create operational clarity through strategic planning

- Invest in people & facilities so we can become our customers’ go-to resource for product engineering and manufacturing supply

- Enhance the company’s leadership and customer teams

- Expand Enbi’s service offerings organically and through acquisition

- Streamline IT and operating systems to become one Enbi worldwide

Close

Weston Forest

Weston Forest

Weston Forest, a leading distributor and remanufacturer of softwood & hardwood lumber and specialty panel products, provides solutions that are essential to the production and shipment of industrial goods as well as commercial and residential construction. The company’s customers and suppliers across eastern Canada and the United States benefit from its diverse business model and concentration on niche markets. The company’s reliability and collaborative and committed corporate culture fuels its brand promise: “YOU’LL LOVE DOING BUSINESS WITH US”.

Acquired January 2021

Strategic Growth

Lumber Distribution & Remanufacturing

CASE STUDY

Where others see:

A commodity lumber distributor

We envision:

A leader in lumber distributing and remanufacturing services, providing high demand products and unmatched customer care.

Watermill is:

- Partnering with the management team to enhance the company’s strategic plan

- Is supporting business expansion across Canada and the United States through organic growth and strategic acquisitions, most recently through the acquisitions of Industrial Lumber Sales, Inc. and Kings Wood Products

- Strengthening systems and processes that position the company for rapid growth and continued success

Close

Musser Biomass and Wood

About Musser

Located in Rural Retreat, Virginia in the heart of the mid-Atlantic hardwood forest, Musser Lumber and its principal operating subsidiary, Musser Biomass and Wood Products (collectively, “Musser”) is the mid-Atlantic region’s leading producer of premium dried hardwood fiber and associated converted products.

Acquired May 2024

Strategic Growth

Premium Dried Wood Fiber

CASE STUDY

Where others see:

A 55-year-old, family-owned lumber business converting hardwood waste into other wood products in a stable and mature industry.

We envision:

An industry-leading pioneer that is not only revolutionizing the way hardwood waste is dried and processed with cutting-edge technology, but is challenging the forest products industry to rethink the value of wood fiber and its sustainable use. By developing high quality products that reduce greenhouse gases, sequester carbon and replace the consumption of non- renewable resources, Musser is redefining recycled wood fiber.

Watermill is:

- Explore emerging applications for clean, dry, biomass fiber

- Support geographical expansion to support and broaden its customer base including evaluating new greenfield sites

- Strengthen the business team and systems to support accelerated growth

Close

SELECT PAST INVESTMENTS

Global Tubes

Specialty Metals

Preferred Compounding

Rubber Compounding

Moore's

Building Supplies

Fine Tubes, Ltd. & Superior Tube Co., Inc.

Fine Tubes, Ltd. & Superior Tube Co., Inc.

Watermill jointly acquired Fine and Superior in September, 2012. Fine Tubes Ltd., located in Plymouth, United Kingdom, is a leading European manufacturer of high-precision metal tubing in stainless steel, nickel, titanium and zirconium alloys. Incorporated in 1943, Fine Tubes’ tubing solutions are designed for use in environments that endure extreme temperatures, pressure, dynamic stress and corrosion, including critical-tolerance applications in the aerospace, medical and energy industries.

Superior Tube Company, located in Collegeville, PA., is a leading North American manufacturer of high-precision, small diameter metal tubing used primarily in highly engineered applications in the nuclear, aerospace, medical and durable goods markets. The company was founded in 1934 to produce high-quality, small diameter steel tubing for the aircraft industry.

Acquired September 2012

Exited May 2015

Family Exit

Specialty Metals

CASE STUDY

Where others saw:

Two independently operated metal tube manufacturers, located on opposite sides of the Atlantic, held back from meeting the demands of the market by their substantial production bottlenecks.

Watermill envisioned:

A combined global entity which leads the market in flawless, high-performance metal tubes; one that proactively anticipates market needs and is deeply valued by customers for making zero-default products for quickly growing end markets.

Watermill:

- Unlocked synergies between these two complementary specialists in elite metals

- Prioritized research and development

- Improved manufacturing operations

- Increased production capacity

- Accelerated global growth

- We implemented our strategy and exited the investment to a strategic buyer for a significant return on invested capital

Close

Preferred Compounding Corporation

Preferred Compounding Corporation

Preferred Compounding Corp. (“Preferred”), located in Barberton, Ohio, develops and produces complex, high-quality precisely manufactured rubber compounds for fabricators of rubber products in the aerospace, appliance, automotive (non-tire), construction, industrial, electrical, water treatment, pharmaceutical and medical industries. Since the Company’s inception in 1973, Preferred has become an established leader in developing and mixing complex-process and high-performance rubber compounds for small-to-medium sized companies.

Preferred Rubber has become a business partner to the leading rubber fabricators in the industry by providing a consistently high level of product quality and service for their compounding needs. By concentrating on custom mixing of rubber compounds, the Company has a special capability to produce high-performance rubber that meets the stringent requirements of its customers. The Company’s strong reputation for superior quality, service and delivery has made Preferred the custom mixer of choice for even the most demanding customers.

Acquired May 2002

Exited December 2010

Acquired in a Distressed Sale

Rubber Compounding

CASE STUDY

Where others saw:

A compounding business that was overly reliant on the auto sector.

Watermill envisioned:

A technical partner for diverse companies operating in industries that need highly engineered, high quality elastomeric compounds.

Watermill:

- Added new acquisition, Associated Rubber, which provided scale and geographic reach into the Southeast

- Upgraded control systems, chemistry personnel and vendor relationships

- Populated management team with senior leadership from outside the industry

- Realigned strategy to more effectively focus on the customer

- Restructured sales and marketing department

- We implemented our strategy and exited the investment to a financial buyer for an overall return of 9x invested capital

Close

Moore’s Lumber & Building Supplies, Inc.

Moore's Lumber & Building Supplies, Inc.

Now owned by ProBuild Holdings, Moore’s Lumber was a leading mid-Atlantic regional wholesale supplier of high-quality building materials to professional builders and contractors.

Moore’s, headquartered in Roanoke, Virginia, was among the top 25 suppliers of lumber and related building material component products in the United States. Moore’s sold its products and services primarily to residential and commercial building professionals and repair and remodeling contractors. At the time of exit, the Company operated 19 distribution centers.

Acquired October 1997

Exited November 2004

Corporate Carve-Out

Building Supplies

CASE STUDY

Where others saw:

A lumber and building supplier trying unsuccessfully to serve both retail and professional buyers.

Watermill envisioned:

A company capable of dominating the pro-builder market by leaving the retail segment behind and providing superior service to a critical geographic region.

Watermill:

- Partnered and co-invested with an industry leader to leverage market and operations insight

- Realigned the strategy to focus on the professional builder market

- Rationalized underperforming and non-core centers including those in undesirable geographic locations or those serving markets outside the strategic focus

- Extended company offerings to include value-added capabilities to pro-builders

- Refocused performing centers on pro-builder market, replacing their former consumer customers

- Restructured overhead to levels more typical of a contractor -focused business model

- We implemented our strategy and exited the investment to a strategic buyer for an overall return of 7x invested capital.

Close

Vertex

Industrial Distribution

Latrobe

Specialty Metals

Southland Paint

Consumer Paint

Vertex Corporate Holdings, Inc.

Vertex Corporate Holdings, Inc.

Vertex Distribution is one of the country’s oldest industrial fastener businesses, with a history dating back to the early 1800s when Joseph Jenks developed the first practical methods for machining steel rods into bolts in his Pawtucket, Rhode Island forge shop.

Vertex is currently one of the largest North American master distributors of industrial fasteners. The Company distributes corrosion resistant and ferrous fastener products, such as bolts, screws, nuts and washers, for both the inch dimensions markets and the metric dimensions markets, as well as, a full line of rivets. Vertex sources its fasteners products from high-quality manufacturers in Asia, Europe and North America and sells these products to over 2,000 local distributors throughout the United States, Mexico and Canada.

Acquired August 2005

Exited August 2008

Entrepreneur Exit

Industrial Distribution

CASE STUDY

Where others saw:

A distribution company in a declining industry that was overexposed to commodity pricing.

Watermill envisioned:

A leader in the industrial distribution market capable of leveraging its deep relationships with customers and suppliers and its strong sales channels for a wider variety of products.

Watermill:

- Strengthened its core competencies by expanding product offerings and increasing distribution channels serviced

- Rationalized commodity market price fluctuations by taking advantage of competitive industry dynamics

- Installed a new CFO and implemented stronger financial controls

- Acquired new corporate headquarters with state-of-the-art distribution capabilities

- Bolstered sales and marketing teams

- Added new acquisition, All-Metric, in 2006

- We implemented our strategy and exited the investment to a strategic buyer for an overall return of 5.6x invested capital.

In addition, Watermill created a separate investment group to acquire and refurbish a new facility for the company which enabled a critical move from antiquated facilities in Pawtucket, RI to a more functional building in Attleboro, MA and accelerated strategic implementation. The real estate investment returned 5.5x invested capital to investors, including annual distributions of between 15-35%.

Close

Latrobe Specialty Metals, Inc.

Latrobe Specialty Metals, Inc.

Latrobe, headquartered in Latrobe, Pennsylvania, is a leading North American producer and distributor of high quality specialty steels and alloys. Latrobe Steel offers a comprehensive line of high strength aerospace related specialty steels and alloys for technical niche applications, as well as high-speed, tool and die steels. Through its two primary business units, Latrobe Manufacturing (“LM”) and Latrobe Distribution (“LD”), the Company produces and distributes over 300 grades of specialty steel for use in aerospace parts, high performance cutting tools, aluminum casting dies, extrusion and thread roll dies and other demanding applications.

Acquired May 2006

Exited June 2012

Corporate Carve-Out

Specialty Metals

CASE STUDY

Where others saw:

An under-managed corporate subsidiary focused on low margin tool steels receiving limited support from its parent company.

Watermill envisioned:

A company poised to grow into high-value specialty metals and super alloys in order to serve highly technical growing markets.

Watermill:

- Acquired Specialty Steel Supply, Inc. in 2008, a distributor of high quality specialty steels

- Invested $60M in new Vacuum Inducted Melting (VIM) and Vacuum Arc Remelting (VAR) furnaces to increase high-margin capacity by 200% and 30% respectively and enable super alloy capabilities

- Hired new CEO to lead the company through a public offering, received purchase offer before going public

- We implemented our strategy and exited the investment to a strategic buyer for an overall return of nearly 10x invested capital

Close

Southland Paint

Southland Paint

Southland Paint Company was a private label architectural coatings and paint company located in Gainesville, TX. Southland specialized in manufacturing interior and exterior home paints and specialty coatings. Sold by Watermill in 1984, Southland Paint was a member of a group later sold to Sherwin-Williams Company in 1990.

Acquired September 1980

Exited March 1984

Corporate Carve-Out

Consumer Paint

CASE STUDY

Where others saw:

A retail architectural coatings and paint company in a low growth industry trying to compete against name brand industry consolidators such as Sherwin Williams and Glidden.

Watermill envisioned:

A marketing company that used its coatings capabilities to enable specialty retailers to maximize profit per square foot and shelf space utilization by providing high quality private labeled paint, space management and branding support.

Watermill:

- Repositioned the company from one that directly marketed to consumers to one that enabled retailers to better serve their customers

- Reallocated resources to hiring and retaining skilled chemical engineers and color specialists

- Eliminated company branding and labels and focused solely on big box store marketing and support

- A nominal investment yielded a $16M return

Close

Integreyted

Environmental Health and Safety Consulting

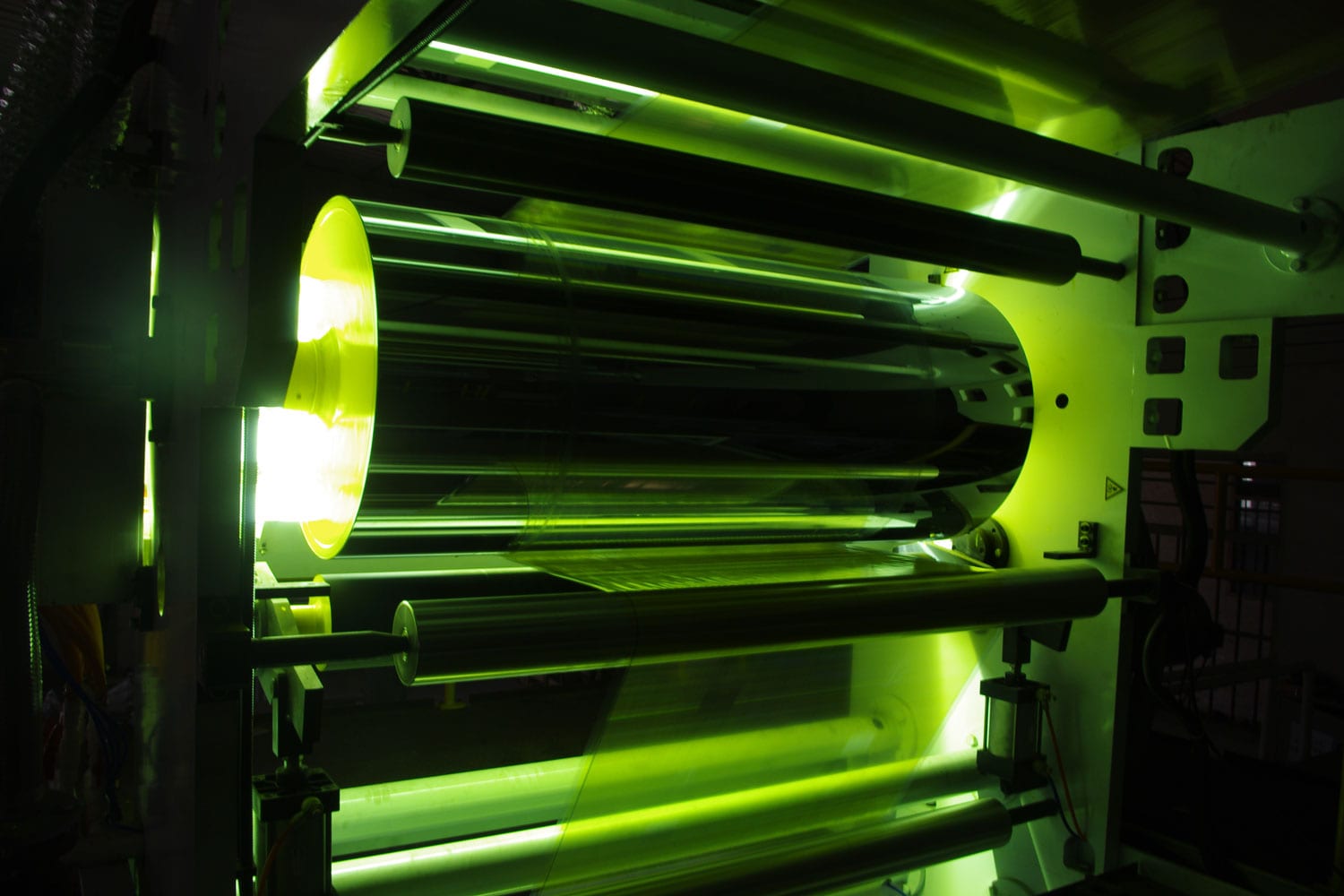

Multilayer Coating Technologies

Specialty Film Coating

C&M Corp

Cable Manufacturing and Assemblies

Integreyted

Integreyted

Now owned by Delta Environmental Consultants, Inc., InteGreyted was an international services firm based in the U.S. delivering EHS solutions worldwide. The Company was founded in 1998 on a clear understanding of the domestic and global dynamics affecting today’s environmental, health and safety services industry. Utilizing the vast resources of their global network, GlobalNetEHS®, and their data and information management web, IntelligentEHS®, InteGreyted redefined the delivery system for global EHS services.

Acquired April 1998

Exited September 2004

Founder Exit

Environmental Health and Safety Consulting

CASE STUDY

Where others saw:

A small, private-sector consultant recently shutdown by its majority owner.

Watermill envisioned:

An environmental health and safety specialist with proprietary software, leading edge IT, and a multinational reach providing high quality consultants with low overhead costs.

Watermill:

- Lent the founders $1M of working capital to restart after their majority owner/partner shut them down

- Helped develop strategy for high level EHS service offering and key corporate clients

- Received 50% equity interest and board control

Close

MultiLayer Coating Technologies LLC

MultiLayer Coating Technologies LLC

Watermill purchased the New Bedford, Massachusetts manufacturing campus from Polaroid under terms which included a one year operating contract to manufacture Polaroid’s iconic instant film. Watermill’s investment thesis was low-risk, high reward: we aimed to take advantage of the year-long runway provided by the Polaroid contract to try to establish stand-alone contract specialty coating opportunities. Ultimately contract volume was not sufficient to sustain long term business in this entrepreneurial endeavor. To date, asset sales have yielded a full return of debt capital plus and 8% return on invested equity. The New Bedford property remains in Watermill’s portfolio with expected total realization of 2x the original equity upon sale.

Acquired August 2006

Corporate Carve-Out

Coating Technologies

Close

C&M Corporation

C&M Corporation

C&M Corporation, headquartered in Wauregan,CT, is an integrated manufacturer of bulk cable, coil cords, and cable assemblies (both molded and mechanical). C&M offers manufacturing options in the US, Mexico, and China and produces a wide range of cable interconnect solutions for the Industrial, Multi‐media, Renewable Energy, Military, Medical, Data Collection, and Datacom/Telecom marketplaces. C&M is a leader in providing engineered interconnect solutions through reliable customer service, world class quality systems, and a wide breadth of manufacturing capabilities that include bulk cable production, internal mold tool fabrication, and innovative assembly constructions.

Acquired April 2008

Family Exit

Cable Manufacturing and Assemblies

CASE STUDY

Where others saw:

A small, high-end job-shop struggling to meet customer expectations and housed in an inefficient plant.

Watermill envisioned:

A professional, tightly run wire and cable solutions provider housed in a modern facility delivering exceptional service levels and engineering leadership to demanding customers.

Watermill:

- Established a scalable platform for growth and shifted C&M’s sales focus to high-growth industrial market segments.

- Created a strong pipeline of demanding customers that value C&M’s engineering expertise and service levels

- Upgraded its facility, equipment and capabilities, including completing a major facility move and retrofit process

- Enhanced the management team to further support customers and offer best in class engineering leadership, high-performance products and exceptional customer service

- We implemented our strategy and exited the investment to a strategic buyer for a meaningful return on invested capital.

Close

Tenere

Advanced Component Fabrication

Tenere, Inc.

Tenere, Inc.

Tenere, Inc. is a leading supplier of custom mechanical solutions for the high-growth markets of information and communications technology, fiber optics and renewable energy. A creative company with expert technical acumen, Tenere has become known for solving complex customer challenges, delivering exceptional and precise solutions and reliably innovating for companies with highly demanding, fast-changing product needs. Founded in 1966, Tenere now operates four metal manufacturing and injection molding facilities in the US and Mexico.

Acquired December 2012

Exited July 2022

Strategic Growth

Advanced Components Fabrication

CASE STUDY

Where others saw:

A metal and plastic parts fabricator with customer concentration and limited strategic direction.

We envisioned:

A leading North American supplier of custom mechanical solutions, offering integrated, end-to-end metals and plastics capabilities to some of the world’s most innovative companies.

Watermill:

- Refocused and reinvigorated Tenere’s business strategy, targeting innovation-obsessed end markets that need a nimble, technologically advanced partner to match innovation demands

- Grew the company organically and through acquisitions, including two-add on acquisitions and a greenfield expansion to Mexico

- Implemented new technologies and equipment across all facilities to improve efficiency and scalability

- Appointed a highly skilled CEO and bolstered the executive management team, creating a foundation for enduring success

- More than doubled the employee population and established a strong financial profile and robust and expanding customer base

Close

DOWNLOAD OUR INVESTMENT CRITERIA

Click below for a detailed fact sheet about the businesses we seek.